Gold Price Forecast: XAU/USD stays on thin ice around $1,800 ahead of key events – Confluence Detector

- Gold price wavers in a familiar range, but the downside appears favored.

- The USD correction is saving the day for gold bulls ahead of key event risks.

- Gold’s path of least resistance appears down, US jobs data eyed.

Gold price has stalled its two-day relief recovery, as sellers are back in the game amid a risk-on rally on global stocks. Traders have looked past the Fed angst, as upbeat corporate earnings lift the mood. The risk-on flows-driven US dollar’s demise and retreating Treasury yields are helping put a floor under gold price. However, the incoming event risks in the US employment data, BOE and ECB rate decisions will provide a fresh direction in gold price.

Read: Gold back to inflection point

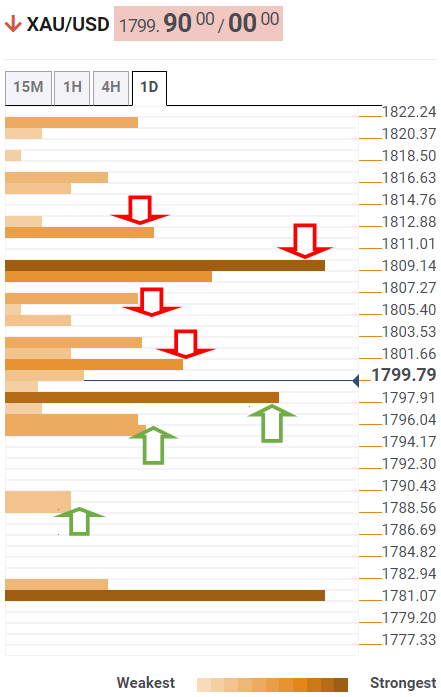

Gold Price: Key levels to watch

The Technical Confluences Detector shows that the gold price is challenging the Fibonacci 61.8% one-day at $1,802 on the renewed upside. At that point, the SMA50 one-day hangs around.

If that level is cleared decisively, then bulls will look out for a confluence of the SMA200 one-day and Fibonacci 23.6% one-day at $1,806.

The next powerful resistance aligns at $1,809, the intersection of the previous day’s high and Fibonacci 38.2% one-week and one-month.

Further up, the SMA200 four-hour at $1,812 will be the level to beat for gold bulls.

On the flip side, the immediate downside cushion is seen at Fibonacci 23.6% one-week and one-month at $1,797.

Sellers will then target $1,795, where the SMA100 one-day and the previous day’s low meet.

A sharp drop towards $1,789 cannot be ruled out on a breach of the latter. That level is the convergence of the Fibonacci 161.8% one-day and pivot point one-day S2.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.